Lawyer Pattaya - Accounting Service Thailand

company balance sheet audit

The annual balance sheet (tax declaration) of a Company Ltd., disregarding the size and the importance of the company, is a very delicate matter, especially in consideration of the fact that most foreigners do not usually understand the content of the huge number of pages they are signing.

Our Law Firm in Pattaya provides transparent accounting services by a registered accountant of absolute trust.

Annual Balance Sheet and Audit at Very Reasonable Rates

Guaranteed by the Social Lawyers Thailand

Thailand's Department of Revenue dictates that all Thai companies shall file an accounting report, financial statement, an audit, following the end of the fiscal year. The first is the balance sheet, or report of financial position, which is a statement on a company's assets, liabilities and equity.

Dormant companies (companies without any activities or revenue) are not exempted from the tax declaration.

A financial report is a formal statement and record of the economic activities of a business, body, or other entity.

It shall exhibit the outcomes of the transactions and the monetary status of a business.

It includes:

Monthly/yearly Financial Reports

Withholding Income Tax

Half-year Corporate Income Tax Return (PND 51)

Value Added Tax Return* (If the gross income is more than 1,800,000 THB)

Annual Income Tax Return

Annual Financial Statement

Accounting Transactions Record

The balance sheet must be presented at least once every year disregarding the dormant status of a registered company. A newly registered Thai company must close accounts within 12 months from the registration.

The formal report shall be certified by an official external auditor then filed with the Revenue Department and Department of Business Development every twelve months.

DORMANT COMPANY

Q: What is a "dormant Company"?

A: A dormant company is, just as a "person" an legal entity without any commercial activities.

Q: Why in Thailand there are so many DormanT Companies?

A: Mainly for two reasons:

1) The large number of people that register new companies "before starting a business" (often waiting for licence etc.)

2) The vast number of foreigners that use dormant companies to purchase real estate.

Q: A Dormant Company must present a balance sheet (tax declaration) and audit every year.

A: Yes absolutely.

Q: What happen if it doesn't?

A: Can be obliged to pay high fines and, in the worst scenario, to face fine and forced closure.

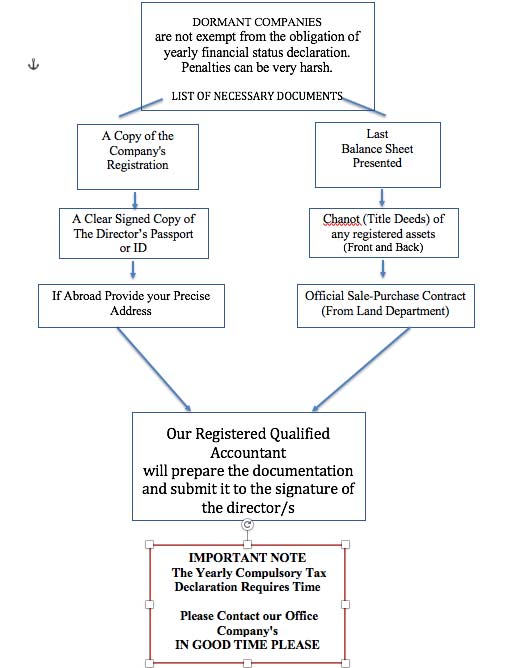

Q: What do I need to show to present the compulsory balance sheet?

A: Look at the following infographic illustration.....

NECESSARY DOCUMENTS AND INFORMATION FOR

ANNUAL BALANCE SHEET OF A

DORMANT COMPANY